Throw it in the trash. Seriously………………….

The time we spend as insurance professionals, benefits professionals, and HR professionals analyzing insurance network discount reports might as well be time spent playing “Candy Crush” on our phones. The similarities are striking actually; they both contain bright colors, you feel like you are exercising your brain, immediately upon finishing there’s a sense of understanding and achievement, and then 5 minutes later, you question, “why did I just spend 45 minutes doing that?”

Insurance carriers and networks have done a tremendous job in promoting the value of their provider networks. We painstakingly agonize over geo-access reports, and we love taking our claims and running them through the various carriers to see if we could save a couple of percentage points with United Healthcare, Cigna, Aetna, or the Blues. And why not… a 2% discount savings for most of us ends up being over $200 per employee per year. That adds up.

So why should we throw those reports out?

The answer is simple… it doesn’t matter what your discounts are when the discount is not based off of anything.

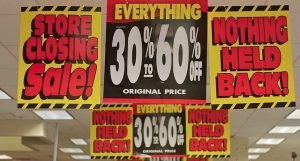

Think of the mattress store in your town that has been “going out of business” for what seems like the past four years. All of the mattresses are 80% off! What a steal! It would be a great deal, except the mattress is 80% off of a marked up price that has no basis in reality. Who would pay a $12,000 sticker price for a basic queen sized, spring mattress?

Or think about when your spouse comes home with three new outfits. It was buy one, get two free! I got two free outfits! Again, it would be a great deal if the first outfit wasn’t four times more than you might be able to get it somewhere else. You didn’t get two outfits for free, you overpaid for three outfits.

In short, a discount only means something when the price that the discount is based off of can be referenced at other locations. I’d rather pay full price for an item at $100 than get a 50% discount on that same item where the sticker price is $400… wouldn’t you?

So how do we bring this full circle back into healthcare? Consider your claims for inflammatory conditions that are run through your medical plan. Most are known as HCPCs J-Codes. J1745 is a big one, for example… you probably have quite a bunch of claims for that… Infliximab… also known as Remicade. Carrier A has negotiated with their hospitals that they will discount Remicade 50% off of their billed charges (queen sized mattress anyone)? Carrier A has negotiated with non-hospital providers that they will reimburse ASP +15% for the same exact drug. Now we compare Carrier A with Carrier B. Carrier B only has a 45% discount on billed charges for Remicade at the hospitals, and the same ASP +15% arrangement with the non-hospital providers. So when we re-run claims through both carriers, Carrier A looks like a champ and Carrier B is the chump, right?

But let’s now assume that Carrier B also has a program that redirects members from outpatient hospital setting for Infliximab infusions to the non-hospital provider settings. Let us also assume that they can quantitatively prove a 90% conversation rate from the hospital to non-hospital setting. Are they still the chump?

Consider this: your average PEPY spend on healthcare sits around $10,000. So a 2% network savings is that $200 PEPY we mentioned before. Now consider that your average Remicade infusion at a hospital will cost a plan $9000 per month, whereas at an office setting, the average would be closer to $4000 per month. So a shift in that site of service can save a plan $60,000 per user per year. In other words, within a population of 300 employees, a 2% network savings has the same value as just one member changing where they receive their Remicade infusions.

Imagine what happens when you factor in other medications such as Humira, Tecfidera, HP Acthar, Cinryze, Stelara, and dozens of others? Or imagine the impact of setting a reference based price for your imaging, or having negotiated bundled pricing for orthopedic surgeries? All of a sudden, those network discounts and access fees start to look less and less significant.

Now let’s compare John and Jane who are both requiring a knee replacement. John goes to Hospital A and Jane goes to Hospital B. Both have negotiated a 50% discount of billed charges, but Hospital A bills $80,000, so the allowed charge is $40,000, while Hospital B bills $60,000, so the allowed charge is $30,000. Your discount report will show a 50% “discount” at both, but who cares?

Meanwhile, Eric is covered under a different plan that has set a bundled reimbursement with the Hospital C at $25,000. Hospital C bills that $25,000, so the discount is 0%. Yet we’d all prefer to take that 0% discount all day long.

It has been decades since the days of the Major Medical reasonable and customary reimbursement plans, but Medicare based reimbursements for non-Medicare members, as well as other UCR style programs are starting to make a comeback, as is the growth in concierge medicine. What’s old is new again. It may not be long before insurance networks become completely irrelevant and obsolete in this new environment.

In the meantime, look at your claims and your data from the perspective of unit cost. Compare medical drug spend to the published Part B reimbursements on the CMS website. Compare different hospital billed and allowed charges for the same exact procedures within your own populations. Evaluate where people are going for infusions, surgeries, imaging, and lab work. Look at carriers and TPAs from the standpoint of who is going to manage the efficiency of utilization as opposed to which network will offer the “deepest” discounts.

If you shift your point of view, you might see a completely different picture.

Director of Data Analytics at Crawford Advisors, LLC, an AssuredPartners Company

Republished with permission. Originally appeared here.