The federal government is cracking down on nonprofit hospitals in an attempt to prevent harsh collection practices and steep charges for the uninsured.

By Sarah Ferris – 12/29/14

The federal government is cracking down on nonprofit hospitals under ObamaCare in an attempt to prevent harsh collection practices and steep charges for the uninsured.

Newly finalized regulations from the Internal Revenue Service, announced Monday, will require nonprofit hospitals to “take an active role in improving the health of the communities” by making payment methods more fair and making costs more transparent.

For example, nonprofit hospitals are banned from asking for money in patients’ rooms or selling debt to third-party companies unless they make a “reasonable effort” to offer financial assistance. Each hospital must also take steps to improve the health of its community, including a semi-annual evaluation of the area’s “health needs.”

“For hospitals to be tax-exempt, they should be held to a higher standard,” Emily McMahon, a deputy assistant secretary for tax policy at the Department of the Treasury, wrote in a blog post Monday announcing the rules.

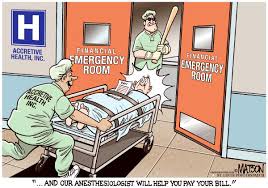

The rules come after complaints that some hospitals aggressively sought payments, sometimes in emergency rooms, which the IRS said “highlighted the need for clear rules to protect patients.”

If a hospital fails to follow the new rules, it could lose its tax-exempt status.

Just over half of all hospitals are nonprofits, costing state and local governments millions of dollars in lost taxes.

The new regulations reflect the final step in ObamaCare’s rules for nonprofit hospitals. McMahon said “many” of threquirements took effect after the law was enacted in 2010.

Still, the agency says that hospitals will have “adequate time to fully update their policies and programming.”

Nonprofit health giants, also known as “charitable hospitals,” have been criticized in recent years as “for-profits in disguise.”