Three underwriters on the way to a conference decided to stop along the way and get a hotel room. It was late at night, but they saw in the distance ahead a hotel with a neon light that said “Vacancy.”

Three underwriters on the way to a conference decided to stop along the way and get a hotel room. It was late at night, but they saw in the distance ahead a hotel with a neon light that said “Vacancy.”

The three underwriters asked to rent three rooms, but was told only one was available. “How much is it?” asked the lead underwriter. “It’s $30” replied the clerk. So each underwriter forked over $10, received the key and went to their room to retire for the night.

But the clerk soon realized that he overcharged the three. Instead of $30, the actual room rate was $25. So he gave his assistant $5 and said “I’ve overcharged for room 34 – return this refund please.”

On the way to room 34 the assistant thought “I will give each of the three men $1 as a refund, and keep the remaining $2 as my tip!”

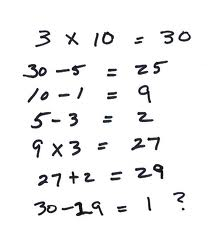

The men were delighted to receive their refund of $1 each. So each originally spent $10, but received $1 back for a net cost of $9 each. That means the three in total spend $27 for the room. And of course the bell hop kept $2 as his “tip”. But where is the missing dollar?

This is much like a TPA showing a renewal increase of 4% when it is really much more than that. Here is how that works:

Fixed from $250,000 to $250,000 (no change), stop loss from $250,000 to $312,500 (+25%), agg attachment from $1 million to $1 million (no change) = 4% “rate increase”

Fuzzy math? A 25% increase in stop loss premium at a 4% “renewal” seems reasonable, doesn’t it? “Sir, you should be happy your getting only a 4% overall rate increase this year. Never mind my 25% increase in stop loss commissions for an additional $9,375 . To renew, just sign here………… (15% of $312,500 – 15% of $250,000 = $9,375 “commission bonus.”