Medical Stop-Loss Premiums Up Nearly 10% for 2022

MyHealthGuide Source: Stephen Miller, CEBS, 8/26/2022, SHRM

This year, the average stop-loss coverage premium for self-insured group health plans in the U.S. increased 9.8 percent for the nearly 250 health plans in HR consultancy Segal’s national medical stop-loss database’s 2022 dataset. That’s up from 8 percent in the 2021 dataset.

“High-cost claimants with $100,000-plus paid annual claims over the last two years accounted for less than 1 percent of all claimants but 28 percent of total medical plan claim expenses,” the report noted.

A growing number of drug therapies can exceed $1 million annually in prescription paid claims for a single individual, Segal pointed out, which “underscores the value of stop-loss policies that cover prescription drug claims.”

Stop-Loss Deductibles

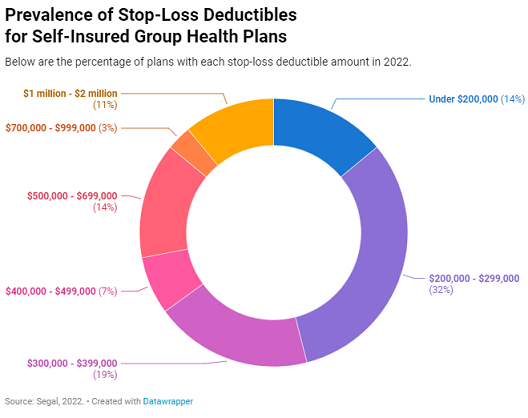

Segal’s analysis shows that in 2022 the most common stop-loss insurance deductible is $250,000, up from $200,000 in 2021.

However, specific stop-loss deductibles continue to vary widely, as illustrated below.

As with medical plan premiums generally, average per-participant stop-loss insurance premiums have an inverse relationship with stop-loss plan deductibles. In other words, as deductible levels rise, premium levels fall.

For a stop-loss coverage plan with a deductible of $200,000, the median monthly per-participant premium was $85.80 in 2022, Segal reported. For stop-loss coverage with a deductible of $500,000, the median per-participant premium was $29.90.

High-Cost Claims

“Currently, 160 million Americans are covered by employer-sponsored health insurance plans, and nearly two-thirds of those plans are self-funded by the employer,” said Steve Gransbury, head of global insurer’s QBE North America’s specialty business portfolio. “As costs continue to rise and the quality of care grows increasingly important, medical stop-loss insurance and related products will continue to serve as key tools for managing volatility.”

QBE released its Accident & Health Market Report 2022 in August. The firm’s stop-loss claim data shows that over 90 percent of patients who incurred claims over $100,000 had more than one chronic condition. The top three cost drivers that triggered stop-loss reimbursements to health plans were:

- Neoplasms, including cancerous tumors.

- Diseases of the circulatory system, including heart diseases.

Premature births.

The size of deductibles affected which conditions are more likely to push claims past the deductible limit, QBE found.

For instance, for stop-loss policies with a $100,000 deductible, breast cancer was the largest single cost driver, accounting for 17 percent of cancer-related claims.

However, for policies with a $500,000 deductible, the largest cancer-related cost driver was lymphoid leukemia, accounting for 25 percent of claims, whereas breast cancer accounted for only 3 percent of stop-loss claims for these policies, indicating that the typical cost for treating breast cancer fell between $100,000 and $500,000.