By Jeff Bernhard – Revive Health

This is an interesting read on wait times for doctor appointments, comparing the United States to other Developed Countries.

Continue reading The Doctor Can See You In Three Weeks (But The ER Doc. Can See You Now)

By Jeff Bernhard – Revive Health

This is an interesting read on wait times for doctor appointments, comparing the United States to other Developed Countries.

Continue reading The Doctor Can See You In Three Weeks (But The ER Doc. Can See You Now)For the longest time, most employee benefits programs have consisted of one-size-fits-all group policies for health and life insurance.

Continue reading How Employee Benefits Will Shift in Next Three Years

TRS ActiveCare, a government health plan for Texas public school districts, has released rates for Plan Year 2023-2024.

Continue reading TRS ActiveCare Publishes 2023-2024 Rates

Warren Buffett said it all: “GM is a health and benefits company with an auto company attached.” In fact, it spends more on health care than steel, just as Starbucks spends more on health care than coffee beans.

Continue reading Dave Chase – “So, How’s Your Health Insurance Business Doing?”

How many American families can afford to pay $31,065 for family health insurance when 90% of working Americans earn less than $100,000 per year and 46% of working Americans earn less than $30,000 per year. After mortgage and car payments, rent, food, gasoline, clothing, beer & fajitas there is no money left for health insurance.

Continue reading Americans Can’t Afford Health Insurance Anymore But Employers Can Because……Dino Chavez, a Brownsville, Texas taxpayer, does an excellent job educating the Brownsville Independent School District’s (BISD) Board of Trustees in under five minutes on the power of managed care contracts and offers a common sense solution.

Continue reading Dino Chavez Educates Board of Trustees On PPO Contracts

We are now authorized to quote and bind Workers Compensation Insurance on behalf of Texas Mutual. In addition to Workers Compensation, HB 3752 authorizes Texas Mutual to establish and market a very different group medical program for employer groups of <250 employee lives.

Continue reading Workers Compensation Insurance

Profiteering Against the Public Interest: Privatization of Health Care by Unitedhealth Group

UHC was just smarter and recognized the direction of the market faster than everyone else i.e. privatize profit and socialize risk…

Continue reading Aldeen’s Sunday Morning Bathroom Read (Memorial Day Edition)

Lt. Col. E. Rusteberg – West Point 1934 – Two Silver Stars, One Bronze Star, Presidential Unit Citation (Battle of Hatten), Purple Heart.

I knew little of my father’s participation in WW2 until after he died. Unlike veterans of today his generation didn’t talk much about it. Their quiet pride was enough, understood by all. The following recounts the Battle of Hatten in which my father was a participant. – Bill Rusteberg

Continue reading Memorial Day 2023

Publicly filed, 5500 forms provide a wealth of information including disclosed (as opposed to undisclosed) insurance broker commissions.

Continue reading Form 5500

Gert-Jan Oskam was living in China in 2011 when he was in a motorcycle accident that left him paralyzed from the hips down. Now, with a combination of devices, scientists have given him control over his lower body again.

Continue reading A Paralyzed Man Can Walk Naturally Again With Brain and Spine Implants

“Hidden” vendors can account for a significant volume of day-to-day transactions, accessing and storing vast amounts of plan participants’ personally identifiable information(“PII”) and personal health information (“PHI”). The delegation tactics used by employee benefit plan service providers place a premium on third-party risk management (“TPRM”) as a strategy.

Continue reading Hidden Vendors & Third Party Risk Management

Wait For Me Daddy!

“That’s probably the last time we were together as a nuclear family, as they put it today,” said Bernard in a recent telephone interview from his home. “We were never together again as a family after that moment.” – Warren “Whitey” Bernard (Blond headed boy in the picture)

Continue reading Iconic Photo In Celebration of Memorial Day

TRS ActiveCare is meeting next week to discuss new benefit changes and rates for the government’s health plan for Texas school districts. Will rates go down? Will benefits increase?

Continue reading TRS ActiveCare To Announce New Benefit Changes & Rates for 2023-2024

File this under “You Can’t Make This Stuff Up”

TRS ActiveCare officials are set to announce benefit changes and new rates next week. The battle to win Texas public school business will be off and running as districts gear up for school year 2023-2024.

Continue reading Epic Battle of The Blues

| [Guidance Overview] IRS Continues Aggressive Course of Proposing Penalties with Letters 226J “[If] the employer’s offer of minimum value coverage to an employee is less than or equal to the product of the federal poverty line and the affordability threshold for that particular year the employee cannot trigger an ACA penalty. This … is true even if the employer does not insert the federal poverty line affordability safe harbor code, 2G, in line 16 of the Form 1095-C…. [T]he IRS is apparently attempting to penalize employers under [IRC] section 4980H on grounds there is no basis for under the law.” MORE >> Accord |

By Bill Rusteberg

When things become political simple decisions benefiting everyone can become hard to make. A circular firing squad kills good ideas swiftly and effectively through “self destructive internal conflict and mutual recriminations.”

Continue reading Sometimes Simple Decisions Are Hard To Make

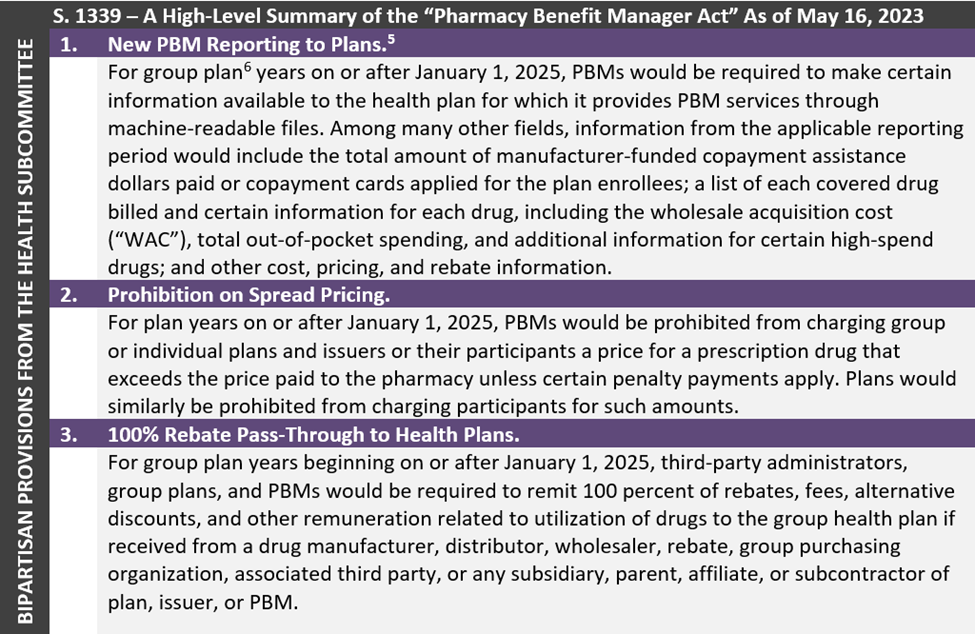

While it is still relatively early in the legislative process, enactment of provisions in the current iteration of S. 1339 would pose significant impacts to entities across the prescription drug distribution chain………………

Continue reading PBM Bill Advances in the Senate

Yesterday Rhea Campbell, Co-founder ImagineMd sent a note that caught my interest:

“We are using QR codes to load plan funds to obtain cash pay pricing. We’re about to go live with a plan on 7/1 that has this option. We trigger the loading when we want to refer for imaging or mammogram for example. Cash pay for these services is slightly less than RBP so we’ll drive even more cost savings.”

Continue reading Why Can’t Plan Sponsors Pay Cash For Healthcare Services With QR Codes?

What’s the best Medicare pricing benchmark plan sponsors should use? Is it 100%, 120%, 150% or 200% of Medicare? Is there a material difference in balance billing issues between these tiers? The answer may surprise you.

Continue reading Reference Based Pricing Benchmarks – Why Pay More When You Can Pay Less?

The over-arching truth – government has been much more effective than private insurers…….

Continue reading Private Insurers Have Failed To Out Perform A Bunch of Bureaucrats

Below is part of a contract we reviewed recently. The Agreement begins:

“The best work comes out of great relationships. Honesty, respect and gratitude are the keys to a great relationship and therefore we have an interest in treating each other with these values at all times. As much as legal documents are important, what truly binds us is our drive to do great work with great people and to develop a relationship of mutual respect and trust.”

Continue reading Great Business Philosophy

A stand alone benefit option that can be added to any plan giving members a choice between free health care or not so free health care at the point of service.

Continue reading Giving Employees A Choice Between Not-So-Free Care and………FREE CARE

Years ago I met a city manager who decided his city’s health plan could be administered in-house and stop loss was not necessary. “We will self-insure and win over time just like stop loss carriers do!” he said.

Continue reading “There Is No Such Thing As A $1 Million Claim”

The NPI Registry is a free directory of all active National Provider Identifier (NPI) records. Healthcare providers acquire their unique 10-digit NPIs to identify themselves in a standard way throughout their industry.

Continue reading What’s Your NPI Number Doc?Since opening our doors in 2006, the BKS Holistic Protection™ model has produced double-digit growth and unprecedented client retention.

Continue reading BKS Partners

| Why Use Liberty Bankers? Below are the bullet points that make Liberty Bankers an attractive carrier to write. Their underwriting and height / weight charts are extremely lenient to get your business issued quickly. |

The government prohibits group health plans and issuers offering group health insurance from entering into agreements with providers, third-party administrators (TPAs) or other service providers that include language that would constitute a gag clause……………..

Continue reading Managed Care Kryptonite Evicerates PPO ContractsWarning: Do not watch this video if you have (a) High Blood Pressure, (b) Ulcers, or (c) Suicidal tendencies.

Continue reading Warning: Viewer Discretion Advised – Video Contains Disturbing Content

Ever told as a kid you couldn’t have something? So you were determined to find a way to get it come Hell or High Water?

Continue reading Best Kept Secrets Never Are

Many small businesses in Texas have raised concerns that they cannot afford to offer traditional health insurance to their employees. As a result, many working families lack access to quality health care. One way to address this issue is through direct primary care.

Continue reading Texas Legislature Considers FQHC Primary Care Access Program

Texans of all political persuasions are fed up with the high cost of prescription drugs and they are about to do something about it.

Continue reading Texas Considers Canadian Drug Importation

If a restaurant charged one person $10 for a meal and charged another person $40 for the same order, it would be considered price gouging—and rightfully so.

Continue reading Texas HB 633 Addresses Medical Price Gouging

As compensation for its services under this Agreement, Gallagher will receive carrier commissions and/or direct fee owed by the Client, as set forth in the Compensation Disclosure Statement attached hereto as Exhibit B.

Continue reading Having Your Cake & Eating It Too

Sunday Morning Bathroom Read (Mother’s Day Edition)

“Gallagher would have a better chance of surviving a forest fire wearing gasoline underwear than trying to explain this…………..?

Continue reading Aldeen’s Sunday Morning Bathroom Read

Looking to save money, the district didn’t go to the “medical mile” for a solution but rather it veered down a small, dead-end, poorly-patched street in Ashtabula where inside a historic home a man and his team are trying to make history by patching the broken business of healthcare.

Continue reading Community Health Plan Saves Money For Public Employees

Cash pay strategies are gaining traction in the market. Here’s a cash pay centric plan funded through individual, (but group paid?), Health Savings Accounts (HSA’s).

Continue reading A HSA Cash Pay Centric Health Plan

Jared Moskowitz bought Merck & Co Inc (MRK:US) on 2023-02-24

“People need to have confidence that policymakers are making decisions based on what’s best for the country, not what’s best for their stock portfolios.”

Continue reading Astute Investor Moskowitz Is Bullish On Merck Stock

By Dean Jargo on Linkedin

When Americans sign up for traditional BUCAH-powered health insurance, what do most assume they’re getting? I believe the following objectives are top of the list for most folks:

Continue reading An Example of Critical Thinking

BACKGROUND AND PURPOSE

An arrangement under which an employer can offer both workers’ compensation insurance and a workers’ health insurance policy would allow employees and their dependents better access to health care. H.B. 351 seeks to provide for a workers’ compensation insurance company to contract with an accident and health insurance company to offer to employers a workers’ compensation insurance policy and a group accident and health insurance policy together in one packaged plan.

Continue reading HB 351

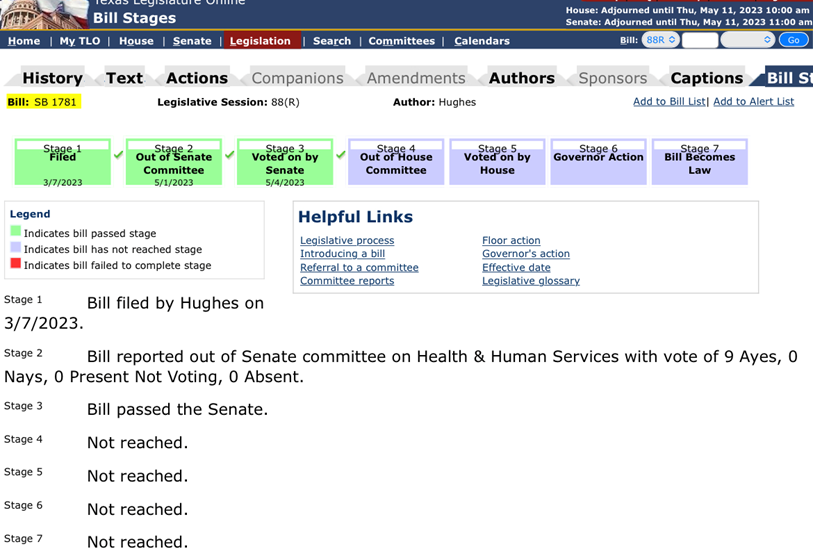

SB 1781 is expected to pass and take effect September 1, 2023. The bill lays out the framework for public school districts to set up and govern health insurance cooperatives for the benefit of their members.

Continue reading SB 1781 Considers Health Insurance Cooperatives For Texas School Districts

Ask Lynn. She got $180,000 for her $500,000 policy. She realized her life insurance was getting more and more expensive each year. Her children were grown and financially independent, so there was no need to keep the policy. She read about life settlements and decided to sell her life insurance for cash.

Continue reading Lynn Sold Her Life Insurance Policy For $180,000

If you have clients on a traditional group plan, you can help them save more money while earning higher commissions with an ICHRA through Remodel Health.

Continue reading Remodel Health Saves 30-50% Over Traditional Group Insurance

A Risk Management Strategy Supported By The American Taxpayer

By Bill Rusteberg

The Compassionate Care Plan™ is a risk management strategy for self-funded employer groups providing an effective method of transferring high risk plan members to the individual health insurance market.

Continue reading Compassionate Care Plan™

I always wondered how it was John (not his real name) seemed to be doing quite well working as a sales rep. for a rental PPO network. His wife didn’t work, he lived in an expensive neighborhood in a major Texas city, and was often vacationing at warm sunny beach resorts with plenty of umbrella drinks at hand. Life was good to John.

Continue reading PPO Rep. Earned Easy Money Back In The Day

In February 2005, insurance broker Wesley Chesson submitted an application to Plaintiff Columbus Life Insurance Company (“Columbus Life”) for a life insurance policy on behalf of Dr. Earl Trevathan, Jr. The application, which was purportedly executed by Dr. Trevathan in Greenville, North Carolina, sought a $1 million policy with a $1 million rider, naming Dr. Trevathan as the initial owner and Dr. Trevathan’s estate as the initial beneficiary.

Continue reading COLUMBUS LIFE INSURANCE COMPANY v. WELLS FARGO BANK, N.A

Reference Based Pricing is not new, it’s been around for a long time. Did you know that Texas Workers Compensation is a Reference Based Pricing plan?

Continue reading Texas Workers Compensation Is A Reference Based Pricing PlanEl Paso ISD uses the CIGNA PPO network. Other districts nearby use Aetna and Blue Cross. Of the three networks, which one offers the best prices?

Continue reading El Paso ISD Believes PPO Network Saves Money

By Bill Rusteberg

Much has been written about the Raymondville Independent School District’s health plan over the past several years. Located in deep South Texas, this small rural school district has solved health care.

Continue reading A School District’s Secret Sauce To Solving Health CareKen Paxton explains how he identified adverse risk factors, quantified expected outcomes, and put into place a strategy designed to mitigate potential losses.

Continue reading Ken Paxton – Risk Manager of The Year

Become A Bona Fide Field Underwriter In Under 5 Minutes!

Continue reading Field Underwriting Aggregate Only Stop Loss Made Easy

Josh Butler, President Butler Benefits

Attention Texas Panhandle Employers!

On Tuesday, May 23, we are hosting an exclusive event to introduce High Plains Health Plan to regional employers, HR professionals, and Civic leaders at Hodgetown Stadium. The formal event will run from 3:00 to 5:00, followed by Happy Hour and networking immediately after.

By Molly Mulebriar

Underwriting a self-funded group medical plan involves assessing the risk and cost of providing health insurance coverage to a specific group of employees or members.

Continue reading Underwriting Self-Funded Medical Plans

Sec. 4151.002. EXEMPTIONS. A person is not an administrator if the person is:

17) a self-insured political subdivision

Continue reading INSURANCE CODE CHAPTER 4151. THIRD-PARTY ADMINISTRATORS

Insurance agent notches up Guinness World Record

91-year old receives recognition but is not yet ready to retire

Joe Sun Yung Tsu, a 91-year-old insurance agent, has been awarded a Guinness World Record for the “longest career as a corporate salesperson”, having spent 62 years and 238 days with Manulife Hong Kong.

Continue reading Joe Notches Up Guinness World Record

The court stressed that “[t]he fact that [Blue Cross] could make claim payments only with the Fund’s authorization, along with the fact that the Fund retained full control over the appeals process, weighs toward finding that [Blue Cross] lacked authority respecting the disposition of the working capital amount.”

Continue reading First Circuit Holds Blue Cross Was Not a Fiduciary When It Allegedly Overpaid, Repriced, and Mishandled Benefit Claims

For the underwriting process, the insurer receives detailed patient information at high resolution, from the questionnaire answers to results from specific lab tests. This data is used to completely personalize the insurance product, whether for pricing and actuarial purposes, underwriting, or management of the lifecycle of the policy and claims management. MPCheck supports a fully tailored approach to health insurance, and a completely different and more effective mode of risk management.

Continue reading How Breakthrough Technology Is Revolutionizing Medical Underwriting

Sheba Virtual Hospital “Beyond” is making it possible for people to perform periodic medical examinations at work or at home.

Continue reading New Development In Virtual Hospital Will Make Being Healthy Easier

This year, the Texas Legislature has the opportunity to repeal the anti-competitive, out-of-date state law guaranteeing Medicaid business to underperforming health plans.

Continue reading Mandatory Government Contracts Benefit Low Performance Health Plans

Risk management is not a static or one-time activity. It is a continuous and dynamic process that requires constant learning and adaptation.

Continue reading Risk Management

Ditch your traditional group health benefits once and for all………………..

Continue reading Remodel Health Says Ditch Your Traditional Health Plan & Replace It With………

Descendants of the Greatest Generation are definitely not Chips Off The Old Block……

Continue reading Researches Discover Mental Health CureHospital Finance 101: Understanding the Cost of Full-Service Healthcare in Pullman, WA Program by: Steve Febus, Pullman Regional Hospital Chief Financial Officer Learn more at

http://www.pullmanregional.org/transp…

Continue reading Confessions of A Hospital CFO