Texas school district seeking stop loss proposals faces significant additional risk exposure through specialty drug lasers.

Continue reading Specialty Drugs Bite Texas School District

Texas school district seeking stop loss proposals faces significant additional risk exposure through specialty drug lasers.

Continue reading Specialty Drugs Bite Texas School District

“The announcement of expanded fertility offerings comes after Walmart in August announced it was expanding its abortion coverage following the Supreme Court ruling that scrapped a nationwide right to abortion.”

Continue reading Walmart Is ConfusedDr. Bricker, in the video above. explains what Direct Primary Care (DPC) is but he doesn’t discuss the three different methods DPC can be incorporated into a group health plan.

Continue reading What Is The Best Method To Incorporate Direct Primary Care In A Group Plan?

Frontier Direct Care taps Flume Health to launch new health plan

“We’re basically able to go to an employer group now and say, ‘Hey, we have this package that will fit your entire healthcare needs,” Lazzopina said. “You’ve got your primary care with Frontier and then we’ve got all of the catastrophic coverage built around that for employer groups.”

Continue reading DPC With A RBP Wrap?

Physicians in Pyongyang’s People’s Hospital No. 2 wearing masks. (Rodong Sinmun)

N. Korea begins annual inspection of hospitals in the provinces

“Hospitals have launched campaigns to at least tidy up the sanitary state of the interiors and exteriors of their buildings in response to the announced inspections,” a source told Daily NK

Continue reading North Korea Begins Annual Hospital Inspections

A Common Sense Approach to Health Care. All financial barriers to health care are eliminated. Providers are paid in cash at the point of service. Never a balance bill.

Continue reading FREE MARKET MEDICAL PLANFive powerful questions that will help you decide if the prospect is a fit for your services:

Continue reading Five Most Powerful Sales Questions

More employers are using the Nancy Reagan risk management method to eliminate high cost drugs through their PBM drug dealer partner. Employers simply can’t continue to pay for expensive specialty drugs anymore.

Continue reading The Nancy Reagan Method

Many years ago I worked for a large insurance company which had a fair amount of federal contracts. One day an executive sales position became open. “Know any Hispanics for the position Bill?” asked the boss. “What! Why does the applicant need to be Hispanic?” I asked. “Because the Home Office says so, that’s why! said the boss.

Continue reading Congress Exams Diversity, Equity & Inclusion Within The Insurance Industry

Mr. Gybbon worked in London as a Salter of meat and fish used to preserve meat. His insurance claim ended up being the first in history to be disputed by the time honored “Loophole Card.”

Continue reading William Gybbon

The Reinsurance Treaty was a diplomatic agreement between the German Empire and the Russian Empire that was in effect from 1887 to 1890. Only a handful of top officials in Berlin and St. Petersburg knew of its existence since it was top secret. (Reinsurance Treaty – Wikipedia)

Continue reading Reinsurance Treaty

We are rewiring healthcare for self-funded employers and healthcare providers. Join us in cutting out the middle-man.

Continue reading Nomi HealthAttorneys find opportunities in representing plan members who sue plan sponsors over breach of fiduciary duties. Every plan sponsor should watch this video.

Continue reading Coming Tsunami – Employees Suing Plan Sponsors Over Breach of Fiduciary Duties

HEALTHCARE COSTS FOR EMPLOYER-SPONSORED PLANS ON THE RISE

You can’t experience rate something that has never happened before. You can only experience rate after the fact. Was the “going in” equal to the “going out”?

Underwriting is not all about numbers. Intuition plays a role. A combination of both makes for winners in Las Vegas.

Price increases are not yet reflected in trend factors payers use to set premiums…….claims shot up in 2021 due to residual demand from COVID-19………claim activity is projected to normalize in 2022……. health plans will be under pressure to increase provider reimbursement rates in reaction to the rise in inflation as their provider contracts come up for renewal…………..

Continue reading COVID: An Actuary’s Worse Nightmare

Ask anyone what “COVID” stands for and you’ll probably get blank stares. So we thought it would be good to explain it.

Continue reading What Does “COVID” Stand For

Louisiana regulator proposes $20 million plan to fund insurer incentive program

Continue reading Louisiana Wants To Pay Insurers To Lose More Money

BSA Health System (BSA) in Amarillo sent Blue Cross a notice of termination and a demand for higher prices. If neither side can agree, BSA intends to leave the Blue Cross network on Dec. 8, 2022

Continue reading Amarillo Hospital Threatens Blue Cross

Less than 60% of all American companies offer health benefits to their employees.

About 57% of the companies offer health benefits to their employees which is less than the 68% and 69% recorded in 2000 and 2010. Approximately 99% of all large firms and 56% of all small firms provide health coverage to employees. The lowest share of businesses with health benefits of 47% is seen among companies with 3-9 workers, according to health insurance data.

Continue reading Employers Are Dropping Group Health Plans

What’s the “real” employee rate for TRS ActiveCare? Will TRS ActiveCare compete in the voluntary benefits market next year? Will the government health plan morph into a high risk pool by acting as a stop loss carrier?

Continue reading Segal Issues TRS ActiveCare Report

With its employee health plan in financial crisis, Montana hired a former insurance insider who pushed back against industry players with vested interests in keeping (health care) costs high. Now we learn a major industry player is back in the saddle.

Continue reading Blue Cross To Administer Marylyn’s Reference Based Pricing Plan

By Wendell Potter – President at Center for Health and Democracy

On top of what you and/or your employer already pay insurance companies in annual premiums and out-of-pocket expenses — insurers also get a skim of your taxes!

Continue reading Buy Government Backed BUCA Stocks – You Can’t lose

Costco has a health insurance plan and marketplace where clients can view and compare prices for different health insurance lines. To do this, Costco recently merged with Custom Benefits Consultants (CBC). How are local independent insurance brokers going to compete with Costco?

Continue reading Costco Sells Group Medical Insurance Too!

I’ve traveled the state promoting direct primary care but little did I know the DPC revolution has gained a foothold just miles from our ranch in little sleepy Cuero Texas – Bill Rusteberg

Continue reading Direct Primary Care Comes To Cuero Texas

The acquisition is projected to place over $34 billion in premiums annually, and employ more than 5,100 teammates across North America.

Continue reading CRC Buys BenefitMall

According to the Social Security Administration, 1 in 4 of today’s 20-year-olds will become disabled during their career.

Continue reading An Important Employee Benefit For <1% of Payroll

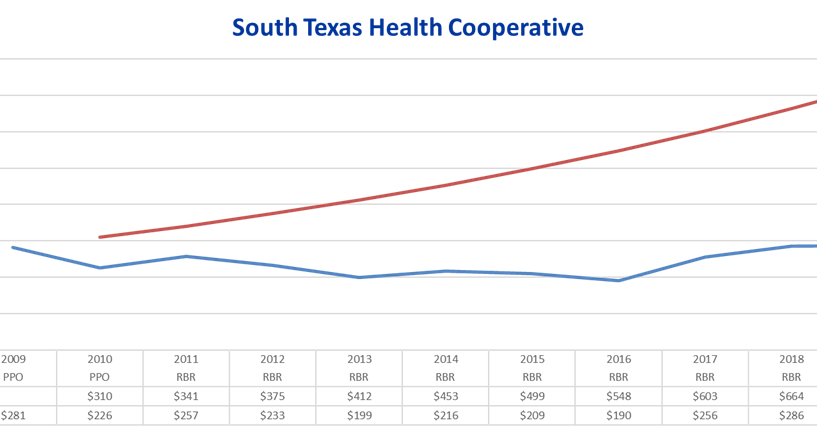

Here’s proof health care costs have remained essentially static for the past 10 years and more. This is a case study on a risk pool established in 1998 for several school districts in South Texas. They have not had a rate increase in 15 years and have improved benefits at the same time. The pool is well reserved. Employee only rate is in the low $300’s.

Continue reading Amazing Case Study Supports Theory Health Care Costs Remain Static…………..

Employers, did you know each of your valued employees may be worth $26,000 more than what you’re paying them these days? The government thinks so. Apply today and get their money. (P.S. – you don’t have to give it to your employees!)

An extra $26,000 per employee could sure sooth the sting of high cost group health insurance…….

Continue reading Government Says You’re Employees Are Worth Up To $26,000 More!

Selling health insurance is not a created sale, it’s a replacement sale………………..

Continue reading Replace Your TPA With This? Really?

This case bears watching closely. If arrangements like Data Marketing are legitimate single employer ERISA-covered health plans, other similar arrangements could proliferate.

Continue reading Fifth Circuit Case Carries Significant Implications for Health Plan RegulationThis airs tonight at 10 pm. The John Oliver video started it all…

Continue reading John Oliver Buys Millions In Texas Health Care Debt

HospitalRe – Turning Tax Exempt Hospitals Into Insurers

Most self-funded health plans have traditional stop loss insurance to protect against unexpected and catastrophic claims. But many are not aware there is another risk transfer strategy – HospitalRe.

Continue reading HospitalRe

SOURCE: ALS Crowd

Before starting treatment, patients and their caregivers should meet with the financial counselor at the facility where they will be treated. Each hospital will have its own financial counselor within each specific clinic. The counselor will help determined coverage and estimate out of pocket costs. There may be restrictions on treatment options covered by Medicare and Medicaid. After you have met with the counselor, the resources below can help bridge financial gaps.

Continue reading Medical Financial ResourcesBy Gerry May – Sep 9, 2022

Mayor Adrian Perkins, flanked by other city leaders, prepares to clarify developments on the health care plan.

SHREVEPORT, La. — City leaders backtrack on health care. For two days, we were led to believe that a controversial three-tier insurance plan for city employees and retirees had been approved.

But it turns out that it was rejected.

Continue reading

11th September 2022 – Author: Matt Sheehan

Kathleen Reardon, Chief Executive Officer (CEO) at Hiscox Re & ILS, has said that she sees “interesting opportunities” for her company at the upcoming January 1st renewals, as signs point to continued reinsurance price increases.

Continue reading Hiscox sees opportunities at hard 1/1: Kathleen Reardon

We partner with select benefit consultants, PBMs, and TPAs in an effort to provide the most competitive pricing for expensive specialty and name brand medications.

Continue reading The War On Drugs Is A Never Ending Battle

At the time of its 2021 funding, Cityblock , a $5.7 billion startup company, cited a 15% reduction in emergency room visits and a 20% reduction in in-patient hospital stays among its first generation of members.

Continue reading Direct Primary Care For Poor People

Nova’s New Podcast Episode Discusses Benefits of Direct Primary Care, Relationship with PCP

MyHealthGuide Source: Nova, 9/8/2022

BUFFALO, NY – Have you ever wondered why your out-of-pocket costs for a visit to the emergency room are much greater than for an appointment with a primary care physician (PCP)? Have you noticed a difference in the quality of care and attention you receive?

Continue reading Benefits of Direct Primary Care

“When I asked what the total billed charge for the procedure was going to be, that completely flummoxed them………………….“

Continue reading Patient Describes Experience At Methodist – San Antonio

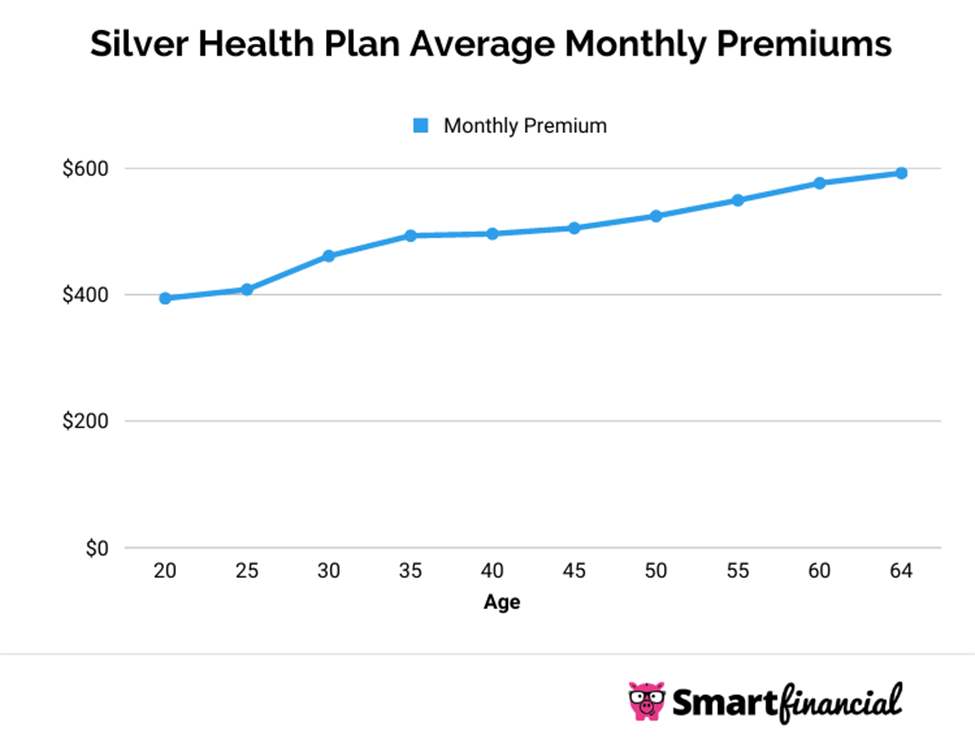

Most states use age 21 as a base rate and then apply a multiplier based on the individual’s age. Rates are generally cheaper for individuals 20 years and younger and higher for ages 22 and up. The premium multiplier is capped at 3.00 for older people — older individuals will not pay more than three times the rate paid by a 21-year-old based on age alone.

Continue reading Average Health Insurance Rates By Age

Employees expect employers to provide health insurance and pay for it. Employers do the former but never the later…………………….

Continue reading Eagle Pass ISD Employees Give Up 16% of Salary For Health Insurance

A True Story

A new hire came to work this summer. She was on COBRA for good reasons. The employer had no idea she was a walking risk management disaster that could bankrupt the firm’s self-funded health plan.

Continue reading Hiring a $500,000 Per Year Employee

Change is constant. Time it’s companion. In 1973 health insurance was “insurance” in the truest meaning of the word.

Continue reading Health Insurance 1973-2022

Interesting information but they are leaving out something. Where are all the hidden revenue streams going? How much are third party intermediaries skimming off the top? Some opine that number is north of 25%.

Value extractors, include but are not limited to, shared savings fees, spread pricing, provider repricing fees, PPO access fees, brokerage fees, government taxes and fees, insurance retention fees, ceding fees, integration fees, compliance fees, renewal fees, termination fees, transaction fees, audit fees, RBP balance bill defense fees, bonus performance fees, subrogation fees, arbitration fees, aggregate accommodation fees, and termination fees.

Continue reading Where Does Your Health Care Dollar Go?

“On Aug. 1, employees will receive new cards with the Cigna logo on them……….” American health care continues to hide behind logos representing fake discounts that don’t matter.

Continue reading The Great American Healthcare Logo Addiction

By Jeff Bernhard – ReviveHealth CEO

My DPC Experience

I have worked in the healthcare industry for roughly 30 years, having served in various senior leadership roles for two of the major national healthcare carriers across just about every state in our country. I have seen the comprehensive nature of healthcare coverage deteriorate so much in those 30 years, and the value is not what it once was. When I first started selling health insurance plans in the Philadelphia area in 1993, plans offered $5 copayments for patients to see a doctor, deductibles were $250 and it took roughly 2-7 days to get any type of doctor appointment. The good old days…

Continue reading Simply Better Health Care

First Primary Care in Houston has landed a spot On Inc. 5000 List of Fastest-Growing Private Companies in the U.S.

Continue reading The DPC Revolution ContinuesThe health insurance industry has a lot of acronyms. PPO, HMO, EPO, CPT, ACA, NSA, MEC, RBP, CPO, and more.

Continue reading Health Insurance Acronyms

A Direct Primary Care revolution is taking place in deep South Texas, catching the attention of primary care physicians across the country.

Continue reading Direct Primary Care Revolution In Deep South Texas

In June 2021, Texas enacted House Bill 3924. The legislation, which took effect in September 2021, allows Texas Farm Bureau to sell medically underwritten health plans that will not be considered health insurance. This means that the plans are exempt from state and federal health insurance regulations.

Continue reading Texas Farm Bureau Sells “Non-Health Insurance” Health Insurance

Most people harbor the belief group health insurance is better than individual health insurance. Years ago that was true but it’s not necessarily true anymore……………………

Continue reading 1,840,947 Texans Enrolled On Individual Health Insurance PlansOptum Acquires Houston-Based Physician Group for $2 Billion. Optum’s network reported to make up over 5% of all U.S. physicians.

Continue reading Optum Acquires Kelsey-Seybold

This stand alone Rx program covers over 425 Generic Medications

No deductibles or copays. Exceptional member experience, available in all 50 states as a stand alone or alongside major medical plans including QHDHP and H.S.A. plans.

Continue reading Stand Alone Generic Rx Plan

Market demand, student outcomes and financial position = strategic and operational action….

By Kasia Lundy

A new study shows that 40% of US higher education institutions are at or nearing financial and operational risk…………..Higher education institutions will need to be more proactive about their financial health to survive in an increasingly challenging landscape.

Continue reading 40% of Higher Education At Risk

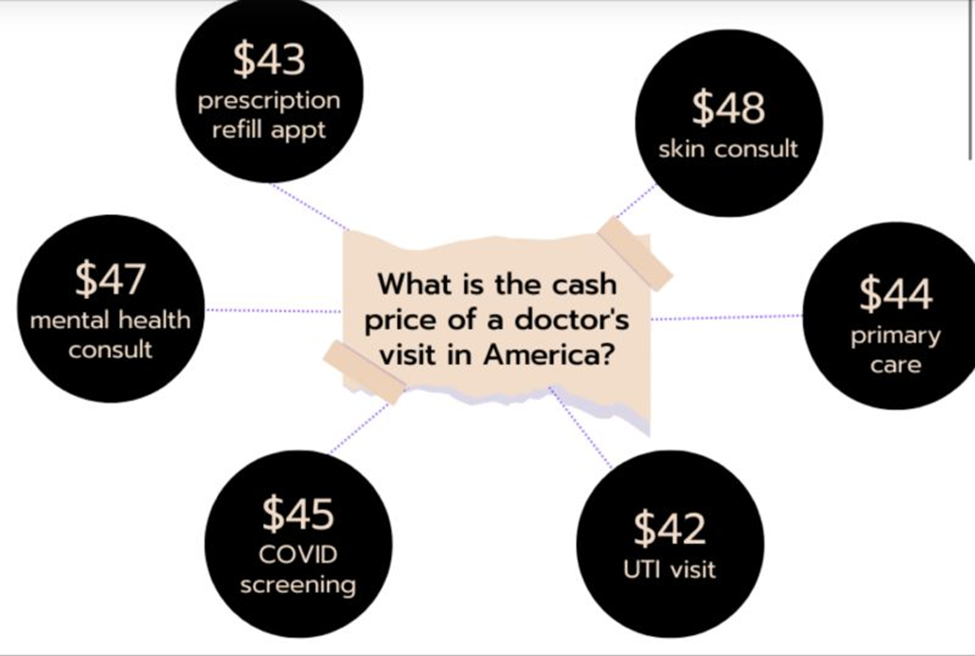

The Insanity of Insuring Office Visits

Why are we insuring office visits? Why not insure flat tires too? Or fan belts? How about windshield wipers? This is insanity.

Continue reading Why Are We Insuring Office Visits?

By Molly Mulebriar

Amazing things happen when out-of-the-box risk management strategies are applied to health care financing. Here’s a text book example of what things can be vs old fashion status quo health plans that are doomed to failure.

Continue reading Amazing Things Can Happen When You Know How

By Dan Avery

Eighty-five percent of workers say they’d leave their job for a company that helped them with their student loans.

Continue reading Student Loan Payment Assistance Is the Hottest New Job Benefit

By Ben Conner August 31, 2022

In early 2021, the American Rescue Plan (ARP) included provisions that increased premium tax credits for individuals enrolled in Affordable Care Act (ACA) marketplace coverage. This allowed people of all income brackets to receive larger tax credits and extended eligibility to those with incomes above 400% of the poverty line for the first time.

Continue reading Single Payer Health Insurance Could Be Right Around The Corner

Found Money ? The Golden Goose WIMPER Plan

Imagine being able to provide more employee benefits for free at no cost to either the employer or employee. Sounds too good to be true doesn’t it? Well…………..you might be surprised or…..you might not…………….

Continue reading Tax Funded Employee Benefit Plan

As the law aged, its rickety construction became clearer, which is why most of the top-tier Democratic presidential candidates in 2020 ran on replacing Obamacare.

Continue reading Obamacare Was “Paid For” By Nationalizing Student Loans